BancorpSouth offers a flexible physician mortgage loan product available at any stage of your medical career. If you have a contract of employment, it will be accepted 90 days prior to beginning practice. However, you will be required to present your first pay stub once it is received. Under this doctor home loan program, you can obtain 100% financing for purchase loans. Both single-family homes and condos are eligible for this mortgage program.

The minimum credit score required by Truist varies depending on the type of loan, but a representative didn't provide specifics. It helps to know minimum credit score requirements by loan type, though. Conventional loans typically require a score of at least 620, while your credit score can be as low as 500 or 580 with an FHA loan, depending on your down payment.

Both the VA and USDA don't set credit requirements, though the lender might have a minimum. Of course, with any loan program, having a higher credit score can help you qualify for the best mortgage rates. A U.S. Bank mortgage loan officer can help you decide if refinancing to a 15-year fixed mortgage is a good option for you. Check out today's rates for 20-year fixedand 30-year fixedrefinance loans. If you're curious about the costs associated with refinancing, use our mortgage refinance cost calculatorto get an estimate of how much it will cost.

1 Exchange many closing cost obligations for a higher rate on your loan. You still may be required to pay interim interest, mortgage insurance, escrows and/or discount points at closing. Certain fees may be collected in advance and reimbursed only upon successful closing of loan. Only available in fixed-rate purchase or refinance loans of $75,000 or more, and may not be available on all loan types, including certain Federal, State or local government programs. Options for lowering your rate may also be available through the payment of discount points at closing.

Eligible veterans can obtain 100% financing using their VA eligibility, to a maximum loan of $679,750, depending on the location of the property. 30-year fixed rate loans are the most commonly used VA mortgage program. Other financing options for home or real property loans include adjustable rate loans.

In this case, the borrower assumes the risk of a higher payment at some point depending on market conditions. Homebuyers who do not plan to stay in the home for a long period or plan to pay off a loan quickly may decide to take the risk of an adjustable rate mortgage. Another perk of doing business with Bank of America is its comprehensive digital services, including an online tool to track the progress of your mortgage loan and refinance application in real-time. While the company doesn't state credit score requirements on its website, you can consult one of their loan officers to see if you qualify for refinancing. Allows qualified buyers purchasing a home in certain rural areas to purchase a home with 100% financing – in other words, no money down. Income limits apply – the borrower has to earn 115% of the US median income or less, to qualify.

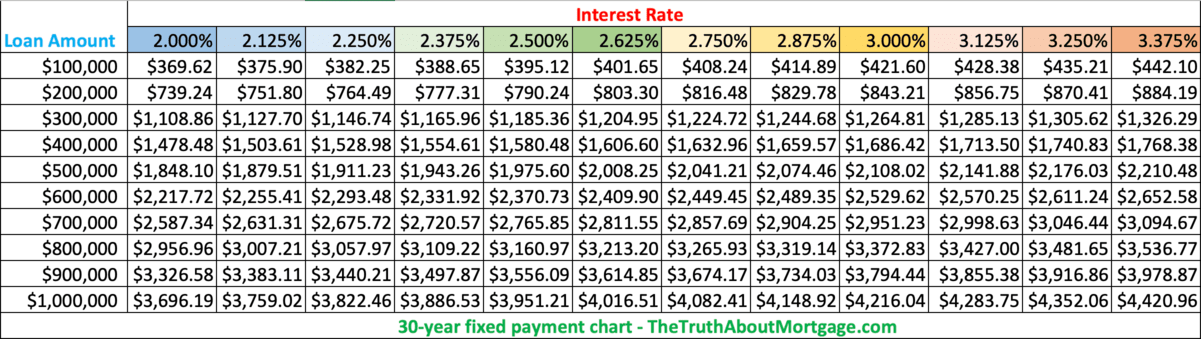

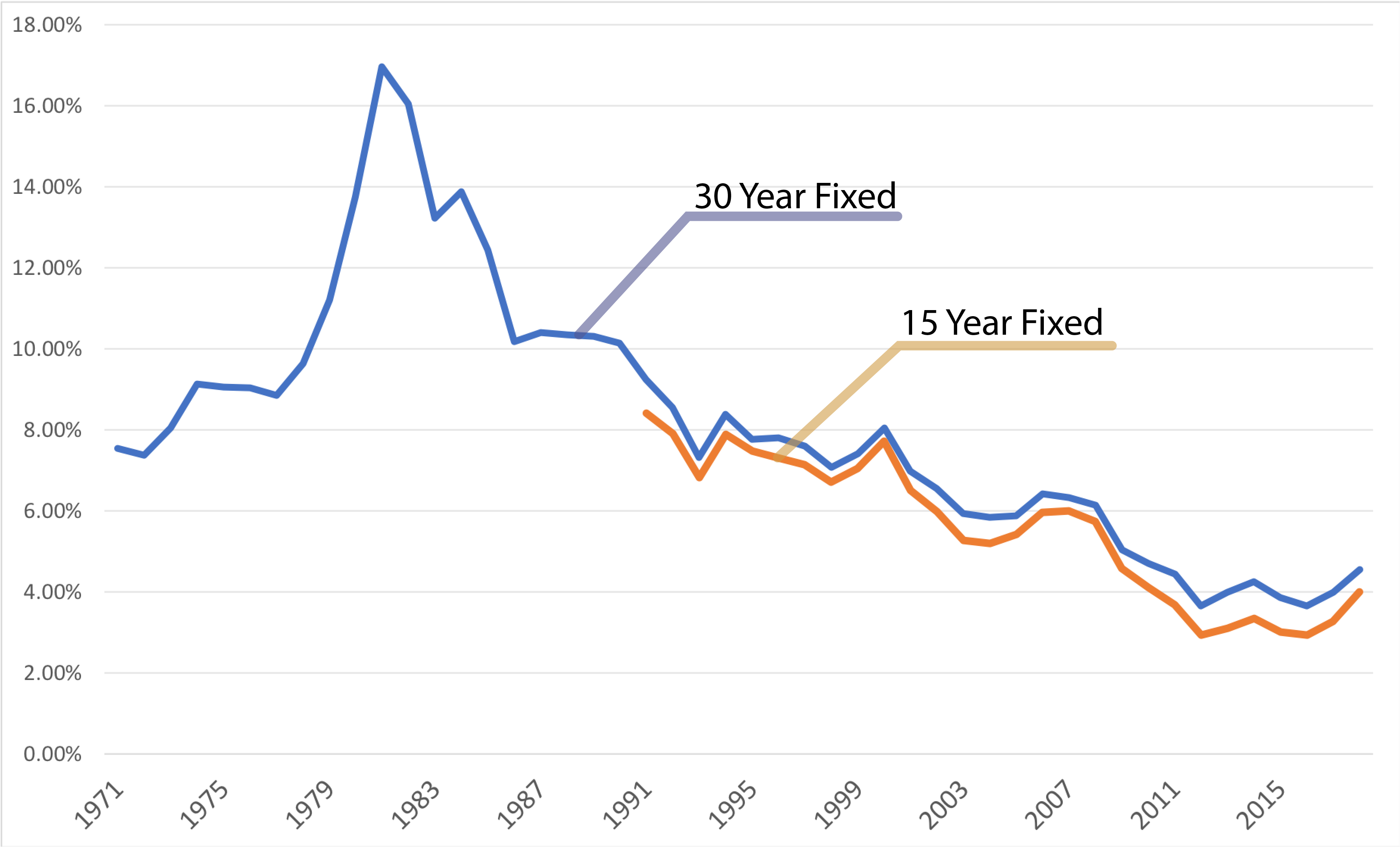

Currently, the US median income is approximately $59,000 annually, so 115%, or $67,850, the maximum one can earn to qualify for a USDA loan. The loan amount may be increased to include the financing of some closing costs if the home appraises higher than the purchase price. Although rates fluctuate to some degree on a weekly basis, watching general trends and economic conditions allows consumers to make the right choice for financing. Selecting a fixed term loan over a variable interest rate mortgage may depend on forecasting how interest rates are expected to change. For example, during inflationary periods when interest rates jump quickly and may be unpredictable, variable rate loans could create a financial hardship for some borrowers. They may find that the lender increased the mortgage payment because the prime rate jumped.

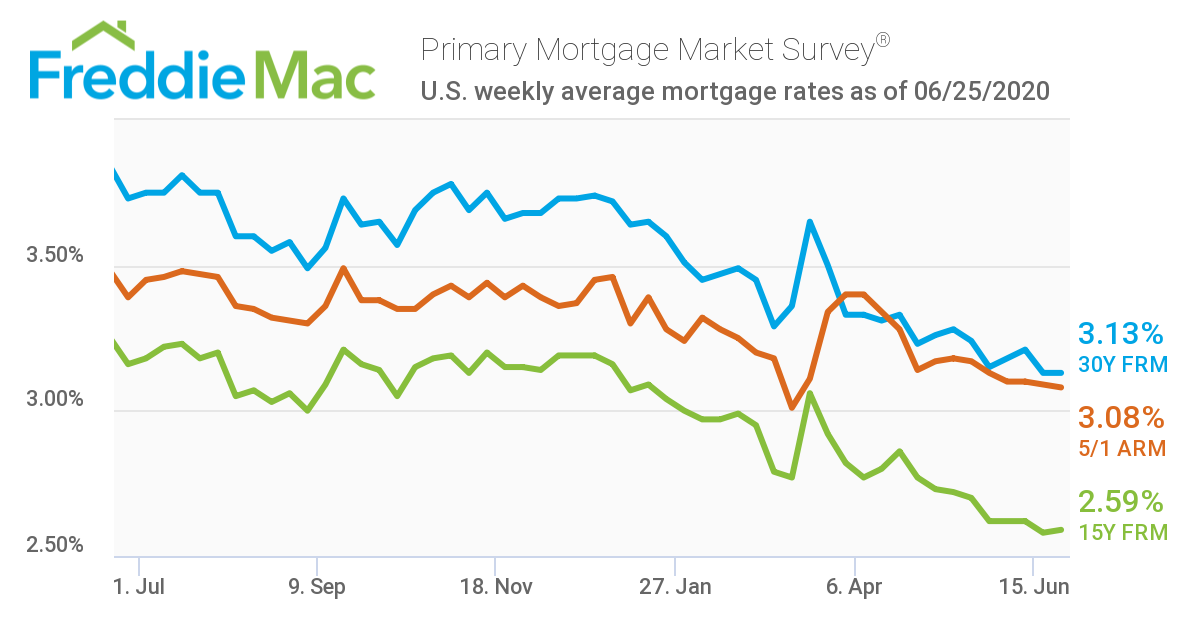

The mortgage payment may continue to rise at the discretion of the financial institution. However, variable loans may be attractive with low starting rates enabling first time homebuyers to get into a starter home. If the loan applicant realizes the risks and has plans to either refinance, move or pay off the loan before an increase they may be a valid choice. These rates can change every day and are based on a few assumptions. For instance, the 30-year fixed purchase rate quote assumes your credit score is higher than 740 and your down payment is at least 20%. You won't find either bank's credit score or debt-to-income ratio requirements online.

Sofi Mortgage is a solid loan partner for the best loans in the market. They require a minimum credit score of 660 and a minimum down payment of 10% for customers seeking to collect a loan. They provide full digital support for clients and do not require private mortgage insurance for jumbo loans. Suntrust's jumbo loans also have significant reserve requirements. This means that, in addition to proving the availability of the down payment and closing costs, the borrower must have six or months of monthly payments in assets that can be liquidated in an emergency.

Every mortgage includes some upfront closing costs for processing and to pay the expenses of writing the loan policy. When moneys are fluid, for example during an economic upturn where financial institutions have abundant resources, some loans may be advertised as free to the borrower. These loans may seem attractive to the borrower but often come at a higher interest rate than other mortgage plans. One way or another you still end up covering the bank's costs & profit margin. Typically a new loan will include a series of fees including points which are 1% of the loan amount and paid at the time of funding to secure a lower interest rate.

Some lenders allow points to be amortized over the life of the loan. SunTrust offers three different jumbo loan programs with terms that vary based on the "depth" of the customer's banking relationship. The maximum loan amount varies based on the loan program but ranges from $1.5 million to $3 million. The website also indicates no mortgage insurance is required on the jumbo loan product but doesn't list the minimum down payment required for SunTrust jumbo financing. The doctor mortgage loan program offered by BMO Harris is available in 9 states to physicians and dentists with a minimum FICO score of 700. No income history is required for this loan program and BMO can close the loan within 60 days of the start date for the new contract.

Mortgage loans available include 10, 15, 20, & 30 year fixed rate or 5/1, 7/1, and 10/1 ARM loans. Better's loan programs offer low interest rates and some of the lowest closing costs in the industry. The company can afford to forego some of the fees charged by traditional brick-and-mortar lenders, such as application, underwriting, and origination fees, since they operate fully online. Additionally, Better offers a price guarantee if another lender has a more competitive price on their refinance products. SunTrust doesn't disclose where its services are available on its website.

If you're interested in its mortgages, contact a representative to see if it services your area.Does SunTrust offer refinancing? SunTrust offers interest rate reduction refinancing for veterans and cash-out refinancing.Does SunTrust sell its loans? The SunTrust site doesn't mention whether or not it sells its loans.What mortgage payment options does SunTrust offer? SunTrust offers a few payment options, including one-time payments, SurePay recurring payments and biweekly mortgage plans. You can easily pay online if you have a SunTrust bank account. You can see current sample mortgage rates on the SunTrust website.

To get a SunTrust rate quote that's customized to your location, credit score and other factors, you'll have to start the online application process or speak with a loan officer. We also look at types of loans and what specific products are available. Finally, we look at the ability to get information online and to carry out online processes as well as customer service, rate information and complaints that have been filed. In contrast, those borrowers holding a fixed rate are protected from an increase during economic inflation.

When interest rates are at a current low trend and forecasted to increase, securing a fixed mortgage becomes an attractive option. The disadvantage is that it may be more difficult to qualify for a 20 year fixed loan than a longer term such as a 30 year fixed because of higher payments and more stringent requirements. This type of loan is a good fit for borrowers who desire low risk and can comfortably meet the qualifications. Yes, doctors get special mortgages — called physician loans or doctor loans — that do not require a downpayment or private mortgage insurance. At the same time, they have very high income potential and a very low risk of default, which is why lenders are comfortable with offering doctors special mortgages. The physician mortgage loan program from NBT Bank is available to physicians, dentists, optometrists, and podiatrists.

The program offers low down payments on loan amounts up to $850,000 in Maine, Massachusetts, New Hampshire, New York, Pennsylvania, and Vermont. NBT Bank's physician loan has a minimum credit score of 700. Flagstar's doctor mortgage program offers no down payment financing up to $850,000 and up to $1.5 million with down payments based on loan amounts.

The mortgage loan program is available in all 50 states for both new purchases and refinancing existing mortgage loans. Sun Trust Mortgage offers a variety of mortgage refinance programs to meet the needs of a broad range of borrowers. But if you can work around those drawbacks, Truist is a great option for most borrowers. It offers all the major mortgage programs, including conventional and government-backed loans, construction loans, and jumbo loans.

First things first, check with your current lender to find out what types of rates they offer. You'll fill out an application, provide the documentation, and pay the fees. You may also want to sit down with an attorney and have him or her review the paperwork. Sometimes, it can take two months or more for a refinance to be finalized. The cost of obtaining a mortgage varies due to differences in financial institutions, unique regions such as states in the U.S., the amount of the loan and several other factors.

The borrower's credit history will often have a significant impact on the cost of the loan and the interest rate being offered. Larger loans such as jumbo loans often carry higher initial fees. A large down payment may reduce the mortgage cost in some cases. Refinancing costs may be slightly less than for an original loan if the same lender is used and agrees to a reduction in their fees, particularly if the borrower has maintained a good credit rating.

Borrowers interested in refinancing hold the best possibilities of ideal timing for a new loan. If the homeowner already has accrued some equity in the property, a refinance could lower the monthly payment significantly if the interest rates have dropped since the initial sale. Although additional fees are involved in refinancing, the advantage of a shorter term loan such as a 20 year fixed over a variable or longer term may offset those costs. A SunTrust mortgage loan officer helps borrowers at each stage of the loan process, according to its website. The ConfidenceNow Pre-approval℠ program is based on unverified information including income, asset and liability provided by the customer.

A physician loan — also known as a physician mortgage loan or a physician home loan — is a special type of mortgage that caters exclusively to medical professionals. Physician loans offer jumbo loan balances with low to no down payments, no private mortgage insurance , and relaxed debt-to-income ratios. This makes physician loan programs very appealing to young physicians, dentists, and other doctors who are looking for home financing.

Aside from refinancing with your current lender, another option is using a mortgage broker, an intermediary between borrowers and lenders. This can be beneficial, as some lenders work exclusively with brokers and offer better rates than a broker's high volume of loans. However, brokers often receive fees from lenders for giving them business, or you might have to pay their fee yourself. You might find lender offers that are better deals in terms of refinance rates, loan products, or closing costs.

While many lenders have their calculators, you can also use our mortgage refinance calculator to get an idea of how much you could be saving. Some lenders offer "no-closing-cost" or "zero-closing-cost" refinance loans for those who qualify. These let you roll up closing costs into your mortgage loan. While you'll still pay closing costs and interest on those fees, it won't be upfront. Specific characteristics taken into consideration within each category include APR, average interest rate, origination fees, minimum credit score requirements, discounts and customer service availability.

Truist also gives homebuyers an option between fixed- and adjustable-rate mortgages. With a fixed-rate mortgage, your mortgage rate never changes. This could be a good option if you find a low rate and you prefer predictable payments.

An ARM offers a fixed rate only for a certain amount of time. Then, based on market conditions, the rate may go up or down at specified intervals for the rest of the loan term. So with a 5/6 ARM, for instance, the rate is fixed for the first five years then adjusts every six months. Truist's ARMs are subject to rate caps per adjustment as well as life of loan. Conventional borrowers who can provide a down payment as low as 3% can get 15- or 30-year fixed-rate loans or adjustable-rate mortgages with fixed introductory periods of five, seven or 10 years.

Additionally, SunTrust Mortgage works with borrowers seeking financing for mortgages that are larger than Fannie Mae's conventional loan limits, known as jumbo loans. Home equity lines of credit are available as well, but home equity loans are not. It's always a tricky question to answer, whether you'd qualify for a mortgage. SunTrust will analyze your credit history to look for red flags and overall creditworthiness. If you have a "good"credit score, that'll increase your eligibility for a conventional loan, which carry the best interest rates. If your credit isn't quite that good, you still have other options for loans, usually government-backed.

SunTrust doesn't specify what scores are required for its loan offerings such as the Fannie Mae and Freddie Mac programs. You'll have to initiate a pre-qualification, loan application or speak to a representative to find out. Rates and program information are deemed reliable but not guaranteed.

Rates on this page are based on the purchase of a single-family, single-unit, detached, primary residence located in Richmond, VA . Rates also assume a 30 day lock for purchase and 90 day lock for refinance, and are subject to change without prior written notice. All rates are subject to length of lock, pricing adjustments for credit score, loan-to-value, property location and additional factors based on loan program. See our current mortgage rates, low down payment options, and jumbo mortgage loans.

These loans are fixed for five years and then adjust annually for the remaining 25 years of the loan. Interest rates are subject to change during the lifetime of the loan. The maximum loan, based on the location of the property, is $679,750. For eligible veterans only, up to 100% of the purchase price of value of the property. Wells Fargo has over 7,400 branch locations servicing 37 states in the U.S. for mortgage refinancing needs. Current rates on a 15-year refinance are 3.399% for standard loans and 3.588% for jumbo loans.

This puts Wells Fargo slightly higher than Chase Bank, but the rates are still competitive. Applicants and borrowers are offered transparency with the ability to track the entire loan process online through the company's YourLoan Tracker technology. With 15-year refinance rates starting at 2.907% APR, Chase is an attractive option for mortgage loan refinancing. Applications and inquiries into personal rate options are available online, via phone, or at one of the nearly 5,000 branch locations in the U.S. Products available only on 5-1 and 7-1 adjustable rate mortgages; no fixed rates.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.