This interest-earning checking account offers customers with more perks than the bank's other bank accounts combined. You'll still have access to overdraft protection, buffers and fee erasers. But being a Premier client enables you to earn triple rewards points on a World Mastercard® credit card and use your Premier Mastercard® debit card at any ATM in the world for free. Your debit card will also carry higher transaction dollar limits, chip technology and fraud protection.

CIT Bank offers one of the highest savings account interest rates of any bank in the nation, online or traditional. The money market account offers an interest rate of 0.45% across all balances, only requires $100.00 to open and has no monthly fees. The drawback to CIT Bank is the lack of a checking account option, which can be inconvenient if you're used to banking on a single platform or like to transfer money quickly. This is similar to other online banks with high-yield savings offers, such as Marcus and Synchrony. If you prefer banking in person, there are solid local options in banking unions and local banks. U.S. Bank offers a variety of financial products and services both individuals and businesses.

The Silver Checking Account is a standard account that has a $6.95 monthly fee, which is waivable by opening a money market account and setting up a direct deposit of $1,000 a month. The monthly fee of $6.95 is lower than other major banks such as Chase Bank or Wells Fargo. U.S. Bank's checking accounts' other requirements and features are very similar to the other major banks, so if you prefer the convenience of banking in person no matter which city you're in, U.S.

Build a stronger financial future with your local branch. Bank products and services, including checking and savings accounts, investment management, refinancing, home equity loans, business checking accounts, credit cards and more. Stop in and visit us, or simply browse our products and services here on this page. Based in San Francisco, "Chuck" is known more as a discount investment broker rather than a bank, but it does offer interest-bearing checking accounts with competitive rates and costs.

You can earn 0.23 percent from a High Yield Investor Savings account and there are no account minimums or fees. Charles Schwab also offers mobile banking, online bill pay, free checks, a debit card, and unlimited rebates on ATM fees worldwide. The only catch is that the checking account must be linked to a Charles Schwab online brokerage account. Pay Bills Pay bills anytime, almost anywhere, with your Bank of America mobile banking app To get started, open your app Sign in. Entering bill information is easy and you only have to do it once. Make sure you have a copy of your bill handy To start, select Add Payee, and begin by choosing whether you want to add a company or a person.

Enter a company name to search the list of major businesses. If the company is found, all you have to do is add an optional nickname, the account number, and zip code. Click on save and you are finished setting up your payee.

If you don't find the company you are looking for, you can always add it by entering in the company's information as it appears on your bill. To make a single payment, simply place a check mark in the box next to the bill you would like to pay, and click on Make Payment. Enter the amount, delivery date, and an optional memo or note. Tap Make Payment, and you will receive a confirmation that your payment has been scheduled.

To pay more than one bill at a time, check the box for each bill that you would like to pay, and click on Make Payment. Enter the amount, delivery date, and an optional memo or note for each payee selected. Tap Make Payment, and you will receive confirmation that your payments have been scheduled. You can find the outgoing payments at the top of the Activity tab. They can be edited or deleted if they have not started processing. Payment History can be found on the Activity tab beneath any outgoing payment.

You can search for payments made or E-bill summary information within the past two years. Click on Filter, and select the date range and status of the history you would like to see. Click on Done, and view the specified payment history. Automatic payments can be set up based on a fixed amount and date.

Or based on E-bill data while making a payment, or from the Payee page. On the Payee page, select Add Auto Pay If you receive E-bills, click on Based on E-bill's amount and due date. Choose the amount you want to pay, and when you want the payment delivered. If you do not have E-bills, you can set up Auto Pay based on a fixed amount and date. Click on Add Auto Pay from the Payee page, and select Using an amount and date I choose. Enter the amount you want to pay, how often you want the payment to be sent, and when you want the first payment delivered.

You choose how long you want this recurring payment to continue. Bank of America makes it easy to securely manage your bills in the mobile banking app. You can confidently use Bill Pay, because we will process your payments based on your instructions. It's banking made easier with the Bank of America mobile banking app. Washington Federal offers a free basic checking account, as a well as a "Green" checking account that's $6 per month and includes cell phone and identity theft protection.

There's also an interest-bearing "Stellar Plus" checking account for those with larger balances. The bank offers two savings account options for $3 or $10 per month, plus certificates of deposit. Passbook savings accounts earn 0.10 percent APY, while CDs can earn as much as 1.95 percent depending on the term length. Founded in 1874, Bank of the West offers traditions banking services such as Checking, Savings, Money Market, CDs & IRAs, Credit Cards, Loans, Home Equity, Mortgages, Vehicle Loans, and Insurance. They also offer online banking, investment services (Mutual Funds, Insurance, Annuities, 401 rollovers, Education Savings, BancWest Investment Services), mobile banking and wealth management .

The Embark Checking Account only requires only $0.00 to open, has no monthly maintenance fees and offers all the standard features. Although the $25 opening requirement is standard across other major banks, the other banks require you to meet difficult requirements to waive monthly fees of $10 or more. This account further stands out due to benefits such as a free savings account if it is linked by deposit to your checking account or ATM fee rebates if your average account balance is over $2,500. Chase Bank is a division of banking behemoth JP Morgan Chase and offers interest-bearing checking accounts with no fee if you have a balance of $1,500 or more. Interest rates on savings accounts range from 0.01 percent to 0.09 percent APY depending on the account and balance.

Rates on certificates of deposit range from 0.02 percent to 1.75 percent depending on term and size. With the AnyDeposit checking account, customers can avoid a monthly account fee simply by making one deposit of any size each month. (Otherwise, the fee is $10.) Premier Checking customers can avoid the fee with a balance of $25,000. Basic savings accounts offer an APY of 0.02 percent on all balances.

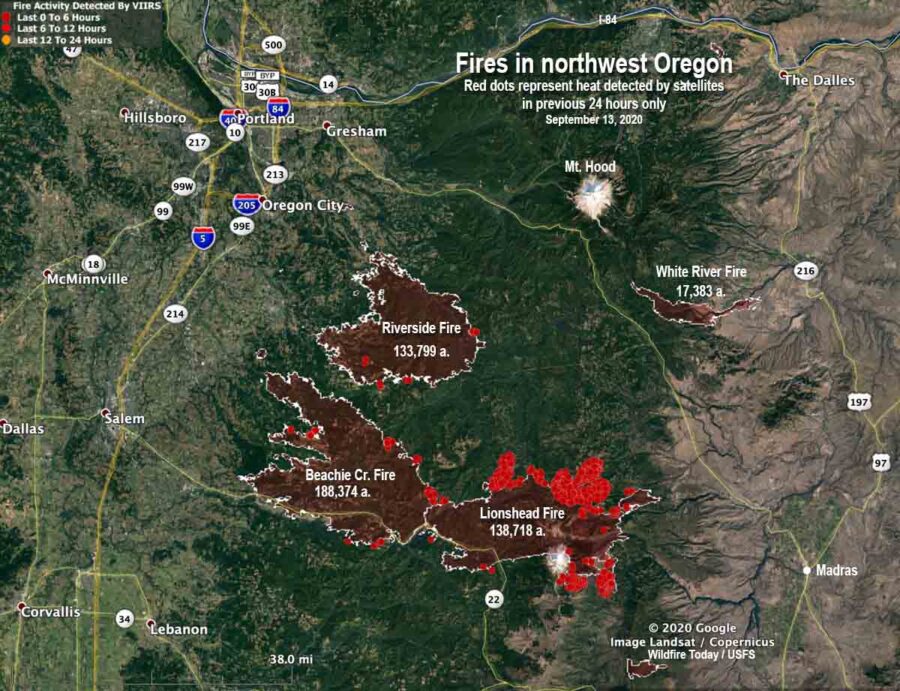

When you have this money market account, you'll never face fees for deposits and withdrawals you make at a branch or ATM. Don't forget that as a savings account, money market accounts still limit your outgoing transactions to six per statement cycle. Walk in our branch and you'll see this is your neighborhood bank, with bankers that care about knowing your name and helping you find financial success right here in the community. Whether you're a business in the Salem area or an individual looking for banking services to help strengthen your financial future, WaFd Bank can help.

From Oregon free checking accounts and mortgages to small business banking and commercial lending services, WaFd Bank is here for all of your banking needs. Bank of the West has customers in all 50 states and operates more than 700 branch banking and commercial office locations in 19 Western and Midwestern states. Prudent credit underwriting, a diversified loan portfolio, and careful risk management have allowed them to grow to more than $62 billion in assets. They are one of the nation's largest banks, yet preserves their local feel and their award-winning style of relationship banking that ensures superior customer service. KeyBank's Student Checking Account has a minimum opening deposit of $50.00, which is higher than the $25 other major banks such as Chase require.

On top of that, there is a monthly fee, which is rarely seen in student checking accounts. However, this fee can be easily waived by making at least five transactions a month. Debit card transactions, deposits, withdrawals and bill payments are all considered qualifying transactions. Zelle in our mobile app is a fast, safe way to send and receive money with friends, family, and businesses you trust no matter where they bank in the U.S. -- with no fees in our app. Follow the prompts to enroll, which include adding your U.S. mobile number or email that others can use to send you money. Say you want to send $20 to Tim for yesterday's lunch.

Enter Tim's contact information or select Tim from your contact list. Enter the amount, select the account, and tap Continue. Verify Tim's information is correct, then tap Send.

If he's already enrolled with Zelle, Tim will get a text or email saying you sent him money, and the funds will go directly to his bank account. If he's new to Zelle, the text or email will include a link with instructions on how to receive his money. You can also request money, like rent from your roommates, or to split expenses for that weekend trip. Keep in mind, with Zelle your money moves from your bank account to someone else's in minutes.

So it's important you know and trust who you are sending money to and never use it with others who you don't know, or to pay for goods and services you have not yet received. So next time you need to send or receive money, just open your Bank of America app and tap Transfer | Zelle. It has unique CD products, such as an 11-month CD with no penalty for early withdrawals and Jumbo CDs with higher interest rates There's also the ability to create customCD laddering.

These days, the geographic location of banks matters less than it once did, as it's entirely possible to do all of yourbanking online. You can access your money wherever you can find the bank. This means at a branch, ATM, online, over the phone or on its mobile app.

Whenever you want to access your money at an ATM, you'll need your Bank of the West debit card and PIN. Be ready to have your personal and account information ready when you want to access your money through any other method. We found Wells Fargo best for small businesses due to the variety of financial products it offers for small-business owners. This includes three different types of business checking accounts and many different types of loans across almost 120 locations throughout Oregon.

Founded in 1874, Bank of the West offers a wide range of banking, insurance, trust and investment services for individuals and business. The bank operates more than 650 retail and commercial banking locations in 19 Western and Midwestern states. Bank of the West is a subsidiary of BNP Paribas, which has a presence in 80 countries with 190,000 employees.

Bank of the West is a subsidiary of BNP Paribas, which has a presence in 80 countries with 190, 000 employees. To obtain a money order or cashier's check from U.S. The catch for those who are eligible to open an account is that Bank of the West doesn't offer the best rates in the industry. Most accounts have interest rates well below the national average. These accounts also have high minimum deposit requirements and monthly fees. Key Features Details Minimum Deposit $100 Access to Your Checking Account Online, mobile, over the phone and at physical branches.

Security FDIC insurance up to the maximum amount allowed by law. These additional deposits must be at least $100, but you can make them at any time. They will earn interest at the rate the account earned when you opened it. It's important to remember that this account is still an IRA. That makes it subject to IRA contribution limits that you have to be aware of. Exceeding these limits can get you into some trouble with the IRS.

Bank of the West makes its simple checking account accessible to more customers with its "any deposit" amount allowances. You can open the account with any amount as your deposit. Plus, you can easily avoid the monthly fee by making a deposit of any amount each statement cycle.

There is no minimum you need to meet to save your money. You have a number of opportunities to earn higher and higher interest rates with a Bank of the West Choice Money Market account. For starters, you should link your money market account to a Bank of the West checking account. The exact rates will depend on the checking account you open and link. Further, there's a balance sweet spot for each set of rate tiers. For example, if you link a Premier Checking account and your money market account has a balance of $50,000, you'll earn at the highest rate possible with a Choice Money Market account.

Most of the following bank accounts have minimum deposit requirements and charge monthly fees. It's important to check those out so you don't get blindsided when you open an account. Bank of the West offers its customers the ease of online and mobile banking. When you access your account online, you can track your spending and budgets, pay bills, transfer money, set up email and text alerts and more. Below, you can find the list of all Tuscaloosa branches.

Click on the list or map below to view location hours, phone numbers, driving directions, customer reviews and available banking services. Banking, credit card, automobile loans, mortgage and home equity products are provided by Bank of America, N.A. And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Programs, rates, terms and conditions are subject to change without notice. CIT does not offer checking, but is a good option for those looking for higher-than-average interest rates on savings accounts.

CIT Bank offers a 0.40% APY through its Savings Builder Account if you maintain a $25,000 balance or deposit $100 per month. Bank checking, savings or money market account can buy and/or sell foreign currency at this branch. Place an order for Euros or other foreign currency and pick them up the next day. Online and mobile banking both allow you to check on your balances, make transfers, deposit checks and more. The mobile app is also equipped with security measures like Touch ID. Bank of the West also charges monthly fees for each of its bank accounts, except its personal CDs.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.